Author: Alex Catalano

Date: Saturday, November 30, 2024

Teddy sits in a chair by my computer desk at dawn

Teddy sits in a chair by my computer desk at dawn

When my stove broke Thursday night, I wasn’t caught off guard. I’d been preparing for unexpected expenses like this by using sinking funds—savings accounts set aside for specific future needs.

When my stove broke Thursday night, I wasn’t caught off guard. I’d been preparing for unexpected expenses like this by using sinking funds—savings accounts set aside for specific future needs.

My stove finally broke Thursday night. In anticipation of this, and other future big expenses, I began using sinking funds.

Sinking funds are savings allocated for specific future expenses. By contributing small amounts regularly, you can handle expected costs, like home repairs or annual fees, without financial stress. For example, if your stove breaks, a sinking fund for home repairs ensures you’re prepared, avoiding surprises.”

Sinking funds are like a compass, helping us navigate major expenses with confidence. Instead of worrying about how to pay for big purchases, they allow us to focus on the features we want.

Carolina and I decided _how much_ we could afford for a new oven range about 18 months ago. It was bittersweet when the old range finally broke; losing something so central to the home is always sad, even if it had its issues.

When the cranberry sauce still hadn’t simmered after 20 minutes, we realized the range was done.

Rather than scrambling, we used an induction burner as a temporary solution while we carefully considered the best model for our home and budget.

We ended up going with the Kitchen Aid dual-oven range.

Carolina’s positive experiences with dual ovens—and her knack for making the most of great appliances—helped convince me it was the right choice.

Opting for a model without front knobs made a high-quality range more attainable for us.

This approach allowed Carolina and me to find a win-win, balancing our needs and budget while ensuring we chose a range we’d be happy with.

At another time in my life, $1,330 might have felt like an impossible expense -- or maybe an insignificant one. Now, it feels like a thoughtful investment in our home.

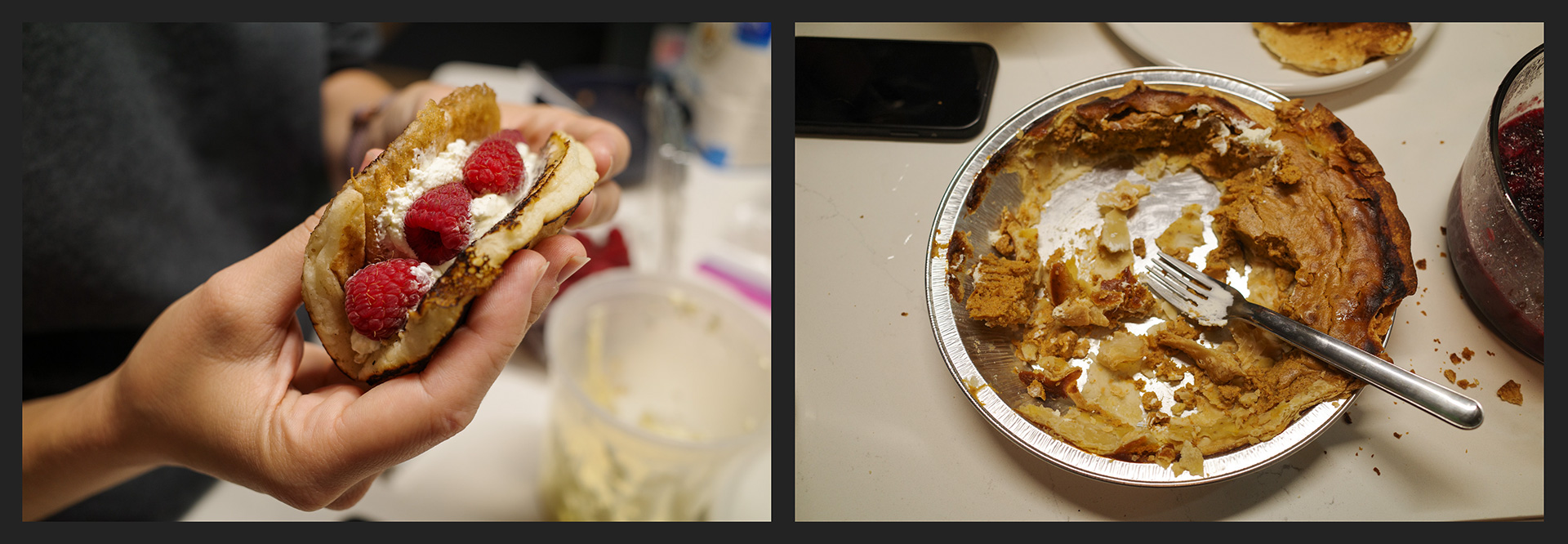

Our Thanksgiving leftovers

Our Thanksgiving leftovers

_Carolina_ crafted a delightful treat, layering tart raspberries with velvety organic, homemade whipped cream, all nestled within a soft, golden pancake shell.

_Alex_ ate a pumpkin pie from side-to-side.

Those two married each other. 💍

Dave Ramsey’s The Total Money Makeover taught me two lessons that reshaped my approach to finances: the importance of a written budget and that every dollar matters—principles that guided me through recent challenges.

Since then, I’ve made a habit of returning unnecessary items—like the tube of silicone in the image above. I bought it with good intentions, but it remains a reminder of how small purchases can quickly add up.

When my fridge started breaking down, I considered using the silicone to fix it. I consulted ChatGPT to avoid a costly mistake, and its advice saved me from turning a small issue into a bigger mess. This approach carried over when Carolina and I tackled the oven range situation.

Carolina and I thoroughly discussed our options for a new oven range, carefully weighing the pros and cons. In the end, we saved $200 from my $1,500 budget.

Historically, I’ve struggled to differentiate between $1,300 and $1,800—both just register as ‘ovens are expensive.’ But when the total came to $1,330, I realized the $500 saved was far more meaningful than the silicone mistake—a clear reminder of the value of thoughtful decisions.

Teddy lays on a mattress that is in the living room while the office is being redone.

Teddy lays on a mattress that is in the living room while the office is being redone.

Teddy, Carolina and Adventure Time ❤️

Teddy, Carolina and Adventure Time ❤️

Carolina helps with moving dirt. It reflects the physically demanding, time-intensive nature of tending to our land as homeowners. Despite the effort, I enjoy it. We’ve had several outdoor projects delayed by obstacles like giant piles of dirt, but each step forward feels rewarding.

Carolina helps with moving dirt. It reflects the physically demanding, time-intensive nature of tending to our land as homeowners. Despite the effort, I enjoy it. We’ve had several outdoor projects delayed by obstacles like giant piles of dirt, but each step forward feels rewarding.

I like that we're seeing progress though. Teddy seems to enjoys having more room for zoomies 🏎️💨.

I like that we're seeing progress though. Teddy seems to enjoys having more room for zoomies 🏎️💨.